Town property owners should have received a copy of a letter advising that the Town is going through a reassessment.

This will NOT result in an automatic increase in your taxes.

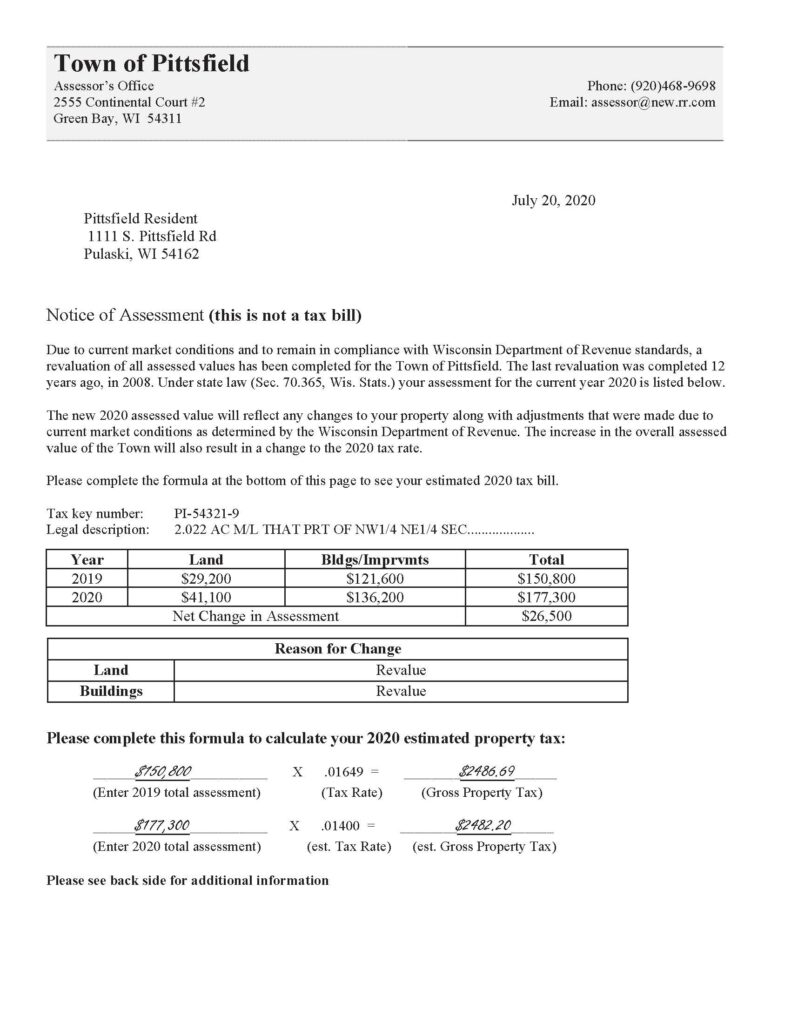

Please review the document you were sent and you will see that while the value listed on your property may change so that the value is closer aligned to actual market value, the taxing rate is actually lowered to compensate. The tax rate is changing from .01649 to .01400.

Please use the formulas listed on the letter to calculate your changes.

If you would like to question the process the first step is to reach out to the assessor. Call Paul Denor at: 920-468-9698.

A sample form is attached.

Our taxes went up $500 this year. Of all years this was not the year to do this to residents. I understand re-evaluation, I understand property values going up, I understand higher home prices are good for the overall value of the town, schools, and resale – my issue is the timing of the evaluation and the increase in property taxes in 2020. This was a hard pill to swallow in July of 2020.

I would strongly recommend that you reach out to the assessor to see if there was an error.